Rotating charges on credit cards can give a major dent to anyone’s pocket. You pay a small amount every month but still see the balance almost unchanged. If you pay a minimum each month, it comes back with additional interest. You may have many reasons for you having very high credit card debt like a home construction or an emergency or medical expense. Whatever might be the reason, getting rid of this high interest debt should be your first priority. There have to be some action plans in your financial planning, that will reduce and eventually erase off all your debts. Here are five best strategies to deal with when you are in a huge credit card debt.

Rotating charges on credit cards can give a major dent to anyone’s pocket. You pay a small amount every month but still see the balance almost unchanged. If you pay a minimum each month, it comes back with additional interest. You may have many reasons for you having very high credit card debt like a home construction or an emergency or medical expense. Whatever might be the reason, getting rid of this high interest debt should be your first priority. There have to be some action plans in your financial planning, that will reduce and eventually erase off all your debts. Here are five best strategies to deal with when you are in a huge credit card debt.

-

- Finish Off Debt from One card at a time

Think upon the thought that which financial goal will make you think that you are doing the right thing to progress and help in debt reduction. If you own more than a credit card, then the answer that will come out is to close one card debt at a time. In specific, close the one with the highest interest rate. On the other hand, if you think that boosting the credit card score is the best idea, then you must go by the highest utilization rate. - Get Low Interest rates from the credit card issuer

If you a person who has a good credit card score, then call your credit card issuer and ask for a lower interest rate. You could get a surprisingly lower interest rate if you a long time user or customer of that card. This helps you save much more on your card. If you get a call from a competitor, then you can get even much lesser interest rate. So it is good to go by it to reduce interest rates and save up some money on it.

- Finish Off Debt from One card at a time

Move Your Balance

Move Your Balance

The best move is to transfer your balance from a high interest rate card to a low one. You can save thousands of money by doing so. You can move only if you afford to pay off the debt each month without holding any debt. Otherwise, your rates might shoot up even more. However, you have to be aware that you have a transfer fee of 3-4% of the total amount that is transferred.- Pay Off Two Payments each month to close debt sooner

Card interest is calculated for each day. So the sooner you pay off, the lesser will be the interest. Make a note in your mobile calendar to remind you. Initially pay off with minimum monthly payments. As you earn more, you can pay off with twice the monthly payments and easily close your debt. - Use Personal Loans

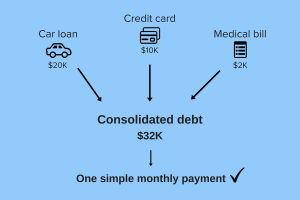

You can take personal loans that offer interest rates much lower than the one on your credit card. This way you can save so much money on your interests. You also have some time interval to save up some money to pay the personal loan monthly payments.